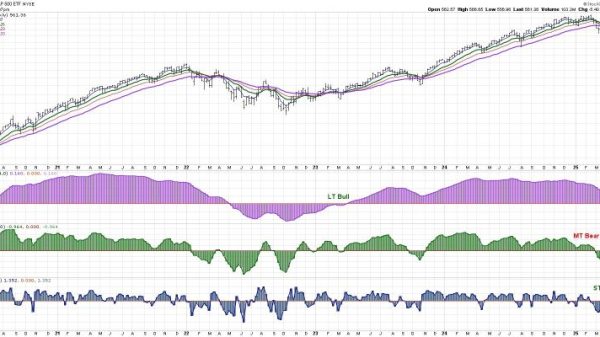

The gold price reached yet another record high on Wednesday (April 16), breaking US$3,300 per ounce.

The precious metal has gained significant momentum since the beginning of the year. In trading on Wednesday it surged past the US$3,200 mark, climbing as high as US$3,354.10 per ounce. The price retreated below the US$3,300 mark on Thursday (April 17).

The rise comes after statements from US Federal Reserve Chairman Jerome Powell made at the Economic Club of Chicago on Wednesday. In his remarks, he said that he expects US President Donald Trump’s tariff policy to negatively impact US economic growth and further fuel inflation.

In addition to gold climbing to record highs, the US dollar sank to its lowest point in three years with the DXY dollar index falling to 99.3 points on Thursday.

Gold price chart, April 10, 2025, to April 17, 2025.

Gold prices have soared in recent weeks amidst the chaos caused by Donald Trump’s tariff announcements on April 2.

Those measures included a 10 percent tariff on all but a handful of countries, including Canada and Mexico, with more severe reciprocal tariffs to come into effect this week. However, on April 9, Trump announced he would pause the additional tariffs for 90 days, saying more than 70 countries had contacted him to make deals.

Trump may have also been feeling pressure from economic advisors as a surge in treasury yields signaled a potential economic crisis brewing in the US bond market. Normally a safe haven during market volatility, the bond market saw a significant selloff this week as US tariffs and worries about the US economy’s stability spooked traders.

Although the pause gave most countries some breathing room, tariffs against China were left on the table. After much back and forth, US tariffs levied against China have now increased to 145 percent.

The net effect of Trump’s actions has been political and financial turmoil, sparking selloffs in major stock markets and pushing prices for safe-haven assets like gold to fresh records.

Additionally, China, Japan and South Korea agreed on March 30 to seek deeper free trade ties in response to the threat of tariffs from the US government. The deal marks a significant move by the three countries following decades of US diplomacy to maintain close relationships with Japan and South Korea.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.